Why Autumn Sunrise?

Location – Autumn Sunrise was an off-market, 142-unit, C+ multifamily asset strategically located in a sought after B class neighborhood. Located in South Corpus Christi on a busy thoroughfare and near Highway 358, Autumn Sunrise has high traffic exposure, a convenient commute to a variety of Corpus Christi’s primary employers and provides residents easy walking access to many local retail shops and restaurants. Autumn Sunrise is situated near Ocean Drive, one of Corpus Christi’s most affluent areas and strongest school districts.

This provided a unique opportunity to transform Autumn Sunrise to a B class asset, capturing a strong investment upside. Having been privately owned and self-managed for several decades, the opportunity existed to dramatically upgrade operational and management systems. Boasting a favorable walkability rating and traffic exposure, historical occupancy is approximately 95%. The neighborhood has stable growth and diverse economic drivers.

Market – The Corpus Christi multifamily market has a history of excellent performance which has only accelerated in recent years. Since 2018 – and through the COVID-19 pandemic – rents have trended upwards with growth accelerating through 2022. The market also has a considerable gap in class A and class B&C rents; this gives highly qualified renters a strong incentive to choose class B&C properties and provides a significant margin for owners to increase class B&C rents through interior value-add programs. Furthermore, occupancies in the market remained strong during the same four-year period. Despite several deliveries, the average occupancy never dipped below 90% and it currently sits just above 92%.

Business Plan

- As a result of long-term self-management, current rents were well below market and will be increased by an average of $150 -$230 with only light interior renovations. The business plan calls for conservative updates to 115 units (81%), correcting minor deferred maintenance items standard to a property of its age, boosting additional income streams through expanded amenity packages, and implementing strong operational 3rd party property management.

- In addition to renovating unit interiors, common amenities will be upgraded to increase the quality of life for residents of the community. Improvements under consideration include adding covered parking, new outdoor kitchens, and seating areas, refresh the pool area and furniture, construct a dog park with outdoor dog wash station, and an upgraded playground. These amenities are key factors in recruiting and retaining quality residents.

- A multifaceted approach will be taken to expand additional income streams and drive Net Operating Income (NOI). Market data shows high demand for in-unit stackable washer/dryers, capturing key rental premiums. Another key driver will be the implementation of pet fees, which are currently not being effectively captured. Inspections indicated more than 50% of the residents currently own pets, serving as an untapped revenue stream on the property. Finally, a comprehensive water conservation plan will be executed with an estimated water usage savings of more than 35%. Our business strategy centers around providing residents an increased quality of day-to-day life and living experience. In close partnership with our management company, Asset Living, property improvements are projected to be completed within 18-24 months. From there, we closely monitor local and national market conditions while continuing to drive NOI year over year, with a target hold period of 5-6 years.

The Investments Projected Returns

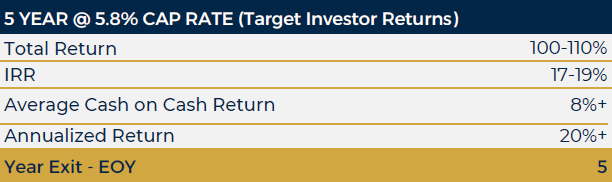

Taking into account the equity gain at resale and the cash flow distributions, the total returns on the investment are projected to be 100-110%, an equity multiple of 2.10X and IRR of 17-19% over a 5 year period.