Why West Georgia Mini Warehouse?

This was a purchase and reposition of 54,000 square feet of self-storage across 426 units in Carrollton, Georgia. The facility is currently 85+% occupied across two phases. Phase I was built in the 1980s and is fully insulated and ventilated despite being non-climate controlled and is 99% occupied. Phase II was completed in Summer 2022 and is currently 65% occupied. The facility is in Carroll County, GA, which has a population of over 120,000, and is rapidly growing, within the Atlanta MSA.

This property is located less than an hour west of Atlanta along I-20, and highly visible along U.S. 27 between LaGrange, Carrollton, and Bremen, GA, a major shipping route which brings ~30,000 vehicles per day of street traffic. About 10,000 people also travel every weekend to the West Georgia Flea Market, which is directly across the highway from this storage facility. A multi-hundred-million-dollar inland port is planned in LaGrange which will likely result in a major increase in traffic along US 27 in the next few years.

The facility is currently well below competitor rates (approximately half) despite significant demand drivers and amenity differentiators being present. The facility is currently being run by hand with no marketing and will likely benefit from our plan to implement a cloud-based management system and online marketing to attract tenants willing to pay higher rates. The facility also has a large percentage of 10×20 and larger units which are desirable from an ownership perspective as they are less price-elastic for demand and less susceptible to collections issues.

Because the land at the site is maxed out, there is relatively little capex required and minimal permitting risk, and this is a strictly operational play-we plan to increase the rents to their correct level (slightly below market), implement web-based management, marketing, and operations, and maximize income from parking and the apartment and billboard on site. We also anticipate that value will also be generated over time by the expansion of the Atlanta MSA into the area-we have projected all the numbers at a 7% cap rate, but over time it is possible that end buyers or lenders would value the facility more aggressively as the metro area expands.

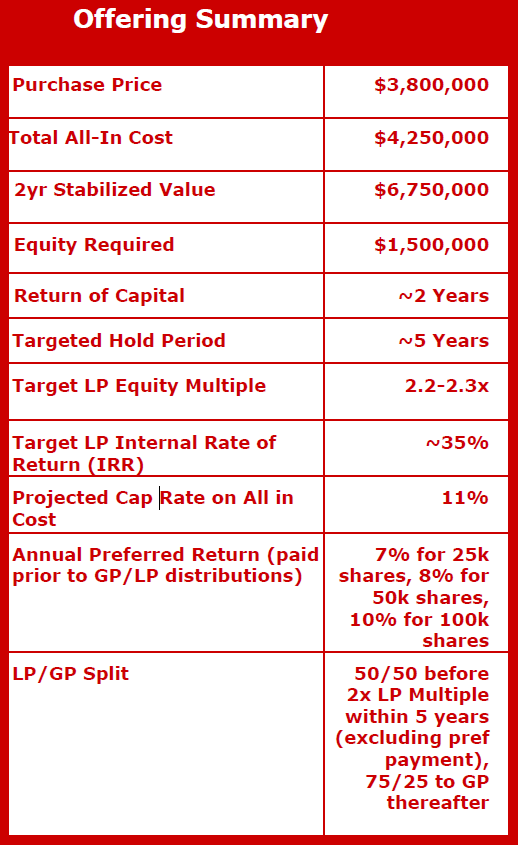

The Investments Projected Returns

Aside from the great return on investment, we especially like the fact that the capital we invest is scheduled to be returned to us around year two while we still maintain our overall stake in the investment. This allows us to reinvest our capital in another property while still getting returns from this one.