South Carolina 100 Unit Mobile Home Park Portfolio

Why Mobile Home Parks (MHP)?

- Recession Resistance – MHPs are resilient and weather economic storms better than most other commercial asset classes and demand typically increases in declining economies

- Affordability – Mobile homes are the lowest-cost form of acceptable shelter in the U.S, filling an important role in high-demand low-income housing. Mobile homes can be built for half the cost of site-built structures.

- Growing Demand – 20% of the U.S. population has a household income of $20K or less. 10,000 baby boomers are retiring daily, many relying on social security income of only $15K per year.

- Barriers to Entry – Most cities discourage new MHP expansion or development; less than 10 new MHPs are being built in the US each year leading to an overall shrinking supply per capita.

- Higher Yields – MHPs have higher capitalization rates and returns than most other commercial asset classes. This is amplified by the relatively low expense ratio (35-40%) as compared to apartments.

- Low Investment Cost per Unit – Investors can acquire more units for a lower entry cost, sometimes as little as $10,000 per pad.

- Low Turnover – It can cost $10K or more to relocate a mobile home. 90% of homes are never moved after being placed. MHP income can be very stable, providing consistent cash flow once stabilized.

- Low Maintenance Costs – In a tenant-owned park, maintenance is limited to the street, pad utilities, common areas, infrastructure.

- Shared Responsibility – Tenants are responsible for home and yard; owner looks after the park and common infrastructure.

Why we love the Greenville-Spartanburg Market

- Geographically located close to both Greenville and Spartanburg, SC and less than 100 miles from Charlotte, NC

- All four parks are located near the upcoming BMW Battery Plant (2 parks within 5 minutes, 2 parks within 25 minutes) and are within 25-30 minutes of the largest BMW Assembly Plant in the world, located in Greer, SC, with 11,000 workers.

- The Greenville-Spartanburg region is known for its mix of art and culture

- Leading automotive hub for the state.

- Extensively connected to regional and global transportation hubs through the Inland Port, interstates, and rail lines

- The proven pro-business climate has attracted major investments from domestic and foreign companies.

- Historically, manufacturing has been the region’s leading labor force and economic driver, but finance and business services are playing a growing role in the region’s GDP.

- The Greenville-Spartanburg-Anderson MSA was ranked seventh in the nation by site consultants considering the top markets for economic development.

- Greenville (ranked 31st) and Spartanburg (ranked 43rd) were mentioned in U.S. News & World Report’s 2023-24 list of the 150 “Best Places to Live in the U.S.“.

- U.S. News & World Report says Spartanburg and Greenville are among the top 25 fastest growing places in the country.

Property Overview

- Appraised at $395k and over 10% above purchase price

- Manufactured housing with 2 single family homes

- 34.7 acres of total land

- 98 total MHP pads with all utilities available at each site

- 95 homes on pads (59 are park owned)

- 3 empty pads with all utilities

- Pad rent: $317/mo average, today; market is $450

- Single family rent: $780/mo per unit today

The Opportunity

This opportunity consists of four MHPs located within 30-minutes of both the upcoming BMW Battery Plant and the largest BMW Assembly Plant in the world, in Greer, SC with a 11,000 strong workforce. Currently, the 4 MHPs are under market rent at an average of $317 per month, while market lot rents are $450 and increasing. Notably, a reputable neighboring park owner is already charging $450 per lot, with plans to increase to $500 next year.

The parks consist of 59 Park-Owned Homes (POH), 39 Tenant-Owned Homes (TOH), and 2 Single-Family Homes (SFH). Of the 100 units, 11 POHs and 4 lots are vacant. The current owner operates the POHs at an astonishingly high 76% expense ratio. Our strategy involves transitioning all lots to TOH by offering rent-to-own options for the trailers, thereby removing repair and maintenance burdens, and transferring property tax and insurance costs to tenants and future owners while retaining trailer titles until payment completion. For those who decline the ownership option, we will gradually not renew their leases and collaborate with the Section 8 HUD housing program to fill these homes at the higher rents. Our connections with the Spartanburg area HUD program are strong, and they are eager to increase available housing options.

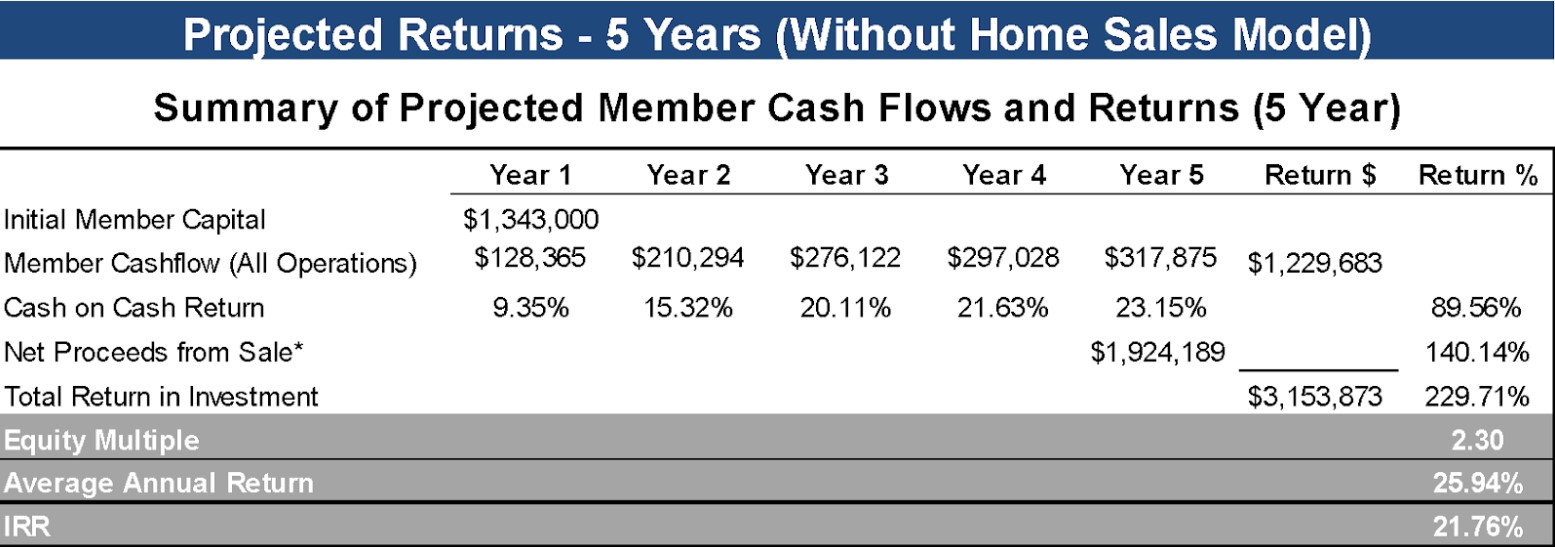

The Projected Returns

Compelling returns; worst case to best case potential with a 5-year ROI rages:

- 16.0% to 24.6% IRR

- 15.5% to 19.6% CoC

- 1.9X to 2.5X Equity Multiple