Why Taku and Alaska?

Alaska, the Overlooked Niche

- Small to medium multifamily properties provide a sense of community

- Too small for insurance and other national firms; too large for “house hacking” and residential loans

- Tertiary cities with durable employment (manufacturing, industrial, government, healthcare) provide quality tenants

- Harsh winter climates deter many investors from visiting to get to know the cities

Why we love Alaska

- Top quintile for GDP growth in 2022; 4th largest cargo airport worldwide

- Anchorage ranked #23 best city to live in USA in 2022

- Alaska’s economy is driven by a range of industries, including oil and gas, healthcare, fishing, and government

- Largest US commercial fishing industry; larger than top 10 combined

- 25,000 active troops stationed in 9 military bases

- The state’s largest city, Anchorage, is in the south-central region of the state and is home to approximately 40% of the state’s population.

- Alaska has the highest yearly population turnover of any state at 11%

- Wages were up 7.9 percent from year ago levels in the first quarter of 2022 and 2.4 percent above first quarter 2019

- Sharply dropping vacancy rate post-COVID reflects tight housing market

- Many partners on this deal live in (life-long Alaskans) or are from the area so we have extensive contacts in and knowledge of the market and are able to have a very hands-on approach to the management of properties in the area.

The Opportunity

The current owners were tired of running the property and wanted to redeploy capital elsewhere. There was a good bit of deferred maintenance in common areas and numerous units that we were able to capture and transfer to the sellers the cost thru repairs and sales credits that allow us to economically bring the property up to our standards. We are also able to implement better tenant management through professional property management, ancillary fees, and operational excellence. We will burn off the loss to lease through re-leasing at market rates. By incorporating an all-inclusive approach on some of the premium units that includes all utilities as well as a covered and heated garage space and a storage unit, we can further push up the rents.

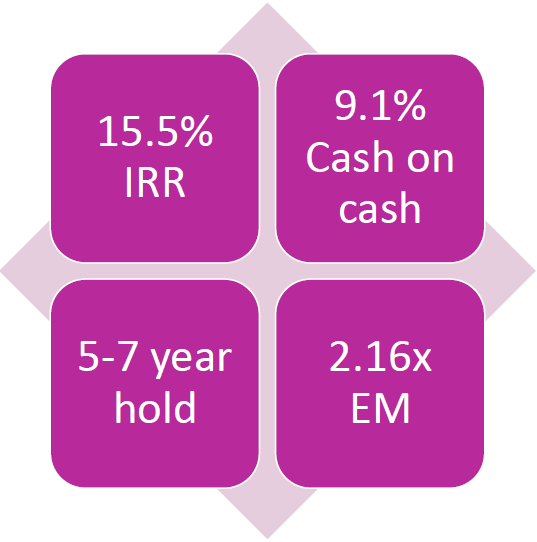

The Projected Returns

The numerous opportunities available to us to increase profitability as well as the strong local market have us excited about the returns on this project. We especially like the 5.4% assumable mortgage that we were able to incorporate that further helps to increase profitability.